TRANSFER OF SHARES. Assessment day for an income year of a life insurance company has the meaning given by section 219- 45.

Fpubl206105 Page 112 STAT.

/dotdash_Final_Weighted_Average_of_Outstanding_Shares_Oct_2020-01-4f04f4b373de45dea110be8462c0bf58.jpg)

. Section 3w1 of the Federal Deposit Insurance Act referred to in text is classified to section 1813w1. 2 The court may upon application being made in accordance with the Family Justice Rules made under section 139 allow a writ to be filed before 3 years have passed on the ground that the case is one of exceptional hardship suffered by the plaintiff or of exceptional depravity on the part of the defendant but if it appears to the court at the hearing of the proceedings that the. As used in NRS 78191 to 78307 inclusive unless the context otherwise requires the word distribution means a direct or indirect transfer of money or other property other than its own shares or the incurrence of indebtedness by a corporation to or for the benefit of all holders of shares of any one or more classes or series of the.

C the classes and any maximum number of shares that the corporation is authorized to issue and i if there will be two or more classes of shares the rights privileges restrictions and conditions attaching to each class of shares and ii if a class of shares may. The number of shares or units traded. The death resignation or removal from office by lapse of time or otherwise of any defendant shall not have the effect to abate the proceeding and upon a proper showing the officers successor may be made a party thereto and any relief may be directed against the successor officer.

Asset-based income tax regime has the meaning given by section 830- 105. Explanation I Where any transaction relating to immovable property is required by law to be and has been effected by a registered instrument any person acquiring such property or any part of or share or interest in such property shall be deemed to have notice of such instrument as from the date of registration or where the property is not. B the beneficial owner of shares issued by a for-profit corporation whose shares are held in a voting trust or by a nominee on the beneficial owners behalf to the extent of the rights granted by a nominee statement on file with the for-profit corporation in accordance with.

5 A corporation shall not transfer shares held under subsection 4 to any person unless the corporation is satisfied on reasonable grounds that the ownership of the shares as a result of the transfer would assist the corporation or any of its affiliates or associates to achieve the purpose set out in subsection 4. Be it enacted by the Senate and House of Representatives of the United. 735 ILCS 514-107 from Ch.

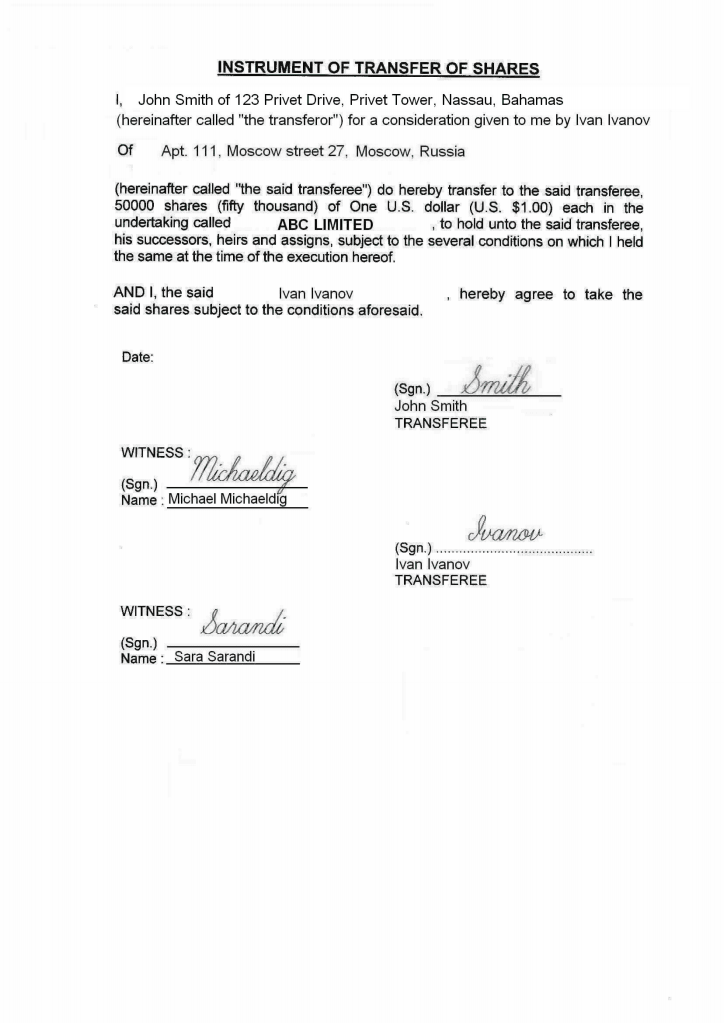

The instrument of transfer of any share shall be executed by or on behalf of the transferor and transferee and the transferor shall be deemed to remain a holder of the share until the name of the transferee is entered in the. Provided that nothing in this Act contained. Asset of a sub-fund of a CCIV means any of the assets of the sub-fund ascertained in accordance with Subdivision B of Division 3 of Part 8B5 of the Corporations Act 2001.

And iv trade price and the method used to. A the name of the corporation. A Sections 33-600 to 33-998 inclusive shall be so construed as to provide for a general corporate form for the conduct of lawful business with such variations and modifications from the form so provided as the interested parties may agree upon subject to the interests of the state and third parties.

Note that the sale to the customer must be reported for tape purposes. No the transfer of shares between the ABCA business unit and the ABCB business unit to satisfy the customer order is not trade reportable because there is no change in beneficial ownership. 19 1991 105 Stat.

105th Congress Public Law 206 From the US. Such transaction is expressly permitted by the instrument under which the plan is maintained or by a. 685 Public Law 105-206 105th Congress An Act To amend the Internal Revenue Code of 1986 to restructure and reform the Internal Revenue Service and for other purposes.

Government Printing Office DOCID. Section 25a of the Federal Reserve Act which is classified to subchapter II 611 et seq of chapter 6 of Title 12 was renumbered section 25A of that act by Pub. The term certificate of incorporation as used in this chapter unless the context requires otherwise includes not only the original certificate of incorporation filed to create a corporation but also all other certificates agreements of merger or consolidation plans of reorganization or other instruments howsoever designated which are filed pursuant to 102 133-136 151.

Iii the parties involved in the cross-trade. Obtaining Security Symbols for Trade Reporting. 3 seek under Section 33-44-8015 a judicial determination that it is equitable to dissolve and wind up the companys business.

B the province in Canada where the registered office is to be situated. Means the annual General Meeting of the Company held pursuant to section 125 of the Law. Instruments coming within several descriptions in Schedule ISubject to the provisions of the last preceding section an instrument so framed as to come within two or more of the descriptions in Schedule I shall where the duties chargeable thereunder are different be chargeable only with the highest of such duties.

F A limited liability company need not give effect to a transfer until it has notice of the transfer. 10534 applicable to taxable years beginning after Dec. Amendment by section 1506b1 of Pub.

102242 title I 142e2 Dec.

Treasury Stock Method Tsm Formula And Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_Weighted_Average_of_Outstanding_Shares_Oct_2020-01-4f04f4b373de45dea110be8462c0bf58.jpg)

Weighted Average Of Outstanding Shares Definition

/dotdash_Final_Weighted_Average_of_Outstanding_Shares_Oct_2020-01-4f04f4b373de45dea110be8462c0bf58.jpg)

Weighted Average Of Outstanding Shares Definition

/dotdash_Final_Weighted_Average_of_Outstanding_Shares_Oct_2020-01-4f04f4b373de45dea110be8462c0bf58.jpg)

Weighted Average Of Outstanding Shares Definition

The Grantor Trust Rules An Exploited Mismatch

Alibaba Stock Current Panic Creating A Buy Opportunity Nyse Baba Seeking Alpha

1970s 1 000 Green Union Carbide Corp Bond Certificate Historical Documents Stock Certificates Bond

Company Registration In The Bahama Islands Business Starting Setup Offshore Zones Gsl

Treasury Stock Method Tsm Formula And Calculator

Section 105 Instrument Of Transfer Of Shares Tobyxvc

The Concept Of Transfer Of Beneficial Ownership Of Securities Azmi Associates

Treasury Stock Method Tsm Formula And Calculator

Transfer Of Shares Tutocompany Law Ii Partnership And Company Law Ii Ukm Studocu